Harpreet S Grover

Hi 👋🏼I have spent the last few years reading, writing and thinking about children and parenting. I also run a podcast called The Curious Parent.I graduated from IIT Bombay and in 2007 started CoCubes. It was acquired by Aon in 2017. Post the acquisition Penguin published our no bull shit book on entrepreneurship called Let's Build a Company I am also an angel investor/coach with 50 odd start-ups including Ola, Ola Electric, Chaayos, Bombay Shaving Company and 15+ EdTech start-ups.In 'my' time I enjoy mountaineering and ultra hill running. After failing to convince my wife to live in the hills, I live in Mumbai with Bhakti and my 6 year old daughter Diya.I find it extremely funny that we live in a world where parenting is taken for granted and every parent knows so little about a child. So I am spending my time in finding the OneKindofChild. If you have 5 min hear this out: The Curious Parent_Genius Baccha

The Art of Angel InvestingAngel investment is a simple concept. You find a start-up and you give money. For that money you get equity in the start-up. If the start-up becomes big and others are interested in buying shares of the start-up, you can sell yours and make a return.35% of my net worth is invested in start-ups, varying from bets of 3L to 50L. And when someone calls me to ask, "what is angel investment like?", the only thing I can think of is: it is an expensive hobby.Why are high returns possible in angel investments? Most angel investments happen at seed stage. The start-up is the seed. The hope is that the seed would grow into a forest and hence return multiple times your money. Unfortunately most seeds die. Some give you a shrub. Few become a tree which gives fruit. Fewer still become a forest. As an angel investor you are looking for the seed which will make a forest.What does it take to spot a unicorn?

There is little at the start that tells you clearly that this will be a great angel investment. The only real thing you have at the start are: the seed (i.e. the founder of the company) and the soil (i.e. which market they want to build in) . These are the only two data points that one has. And the better one gets at reading the founder and the market, the better the chance of a successful angel investment.But how can one find out if the founder has a deep desire to do what he is doing long term and has the execution ability to back his desire? Because passion alone doesn't go a long way in running a company. IQ alone doesn't travel the distance. It is a unique mix of both that seems to result in a positive outcome.The surest way to find this out is if you know the founder for long enough. Then you really know because you have seen the behaviour in the past. You have seen her go get things done that she wanted to do. You have seen her on a project and how as the demand of the project increased, so did her learning curve. Knowing the founding team from earlier also helps avoid a common reason start-ups fail: founder fights.The Signals for the Seed

Knowing the founder from before is not possible most of the times. So what can you do? You look for signals.There are two types of signals here. Data signals and people signals.One of the surest signals is that the senior folks from the company founder has worked in are investing in the start-up. Or if the founder is a fresher, then what do his batchmates think of him? Or someone you know has been tracking the founder for a long time and is willing to place a bet. This is the people signal. When I invested in Bombay Shaving Company, this is something that helped. I did not know Shantanu Deshpande from before and being a Sikh I wasn't going to be a user of the razor which was the first product. But Shantanu was being backed by almost everyone he had interacted with during his professional journey and that was a sign enough for me to take a call to invest.A data signal comes from the founder having done something significant before that makes her stand out. This is one big reason for the bias towards IIT/BITS founders. Because the signal is that this person has competed before and won. So an angel investor believes that she can do it again. May be the founder has worked in a fast growing start-up as an early member and knows what it really takes. May be the founder has a deep personal story that will make sure she will stop at nothing. This was where I missed investing in CueMath. Manan Khurma, the founder had been in the education space and had built a company earlier. When I met him he seemed keen on building a company for teaching maths to kids. I interacted but finally did not end up investing. In hindsight, a skilled founder with an exit under his belt and starting his next venture in the same segment should have been an easy call.If you are someone who has not been part of a start-up earlier, you might not really know what it takes to build a company from scratch. You might find it hard to fathom what skill it takes to actually build the marketing function, HR function, finance function and most importantly build a product that does not exist currently but the market wants. The more fine tuned your personal judgement can be and the stronger you can read the signals, the better your chances of spotting. Even with a perfect spot you can't be sure of a large positive outcome. A lot of things have to fall in place for that to happen.Most of all the market has to be conducive.The environment. The market.

When Vibhore and I started CoCubes - we did not know that we were in the 'EdTech/HRTech' space. We didn't know that when we started that we were classified as a B2B company. We didn't really know that the B2B space in India was not mature to build a unicorn. That investors weren't particularly keen on this market because of that . And by the time we sold CoCubes to Aon in 2016, we had run CoCubes for 10 years. We were experienced, we understood. And we sold the firm. And from the year 2017 onwards B2B became hot. Everyone wanted to invest in B2B. EdTech became the boom.Reading the market is hard. A founder building a company in a market where there is lack of demand (total addressable market is small) is like a seed planted in a desert. However strong the seed might be, it won't survive. The market is important.The common mistakes of angel investors

While it sounds simple that all one needs to do is focus on the founder and the market it is easier said than done. And there is a lot we can learn from mistakes that others (like I) have made. Here are 4 common ones.Emotion Validation Mistake: Let's say you have been able to identify a trend that you think will soon be mainstream. And you start looking for an entrepreneur to back who sees the world your way. And once you find them you want to cut a cheque. The emotion of wanting to see your insight work can stop the angel investor from viewing the founder strengths and weaknesses objectively. The founder might not have the skills to solve the problem and build a company.'I will help' mistake: Another common mistake is one in which you come across a founder whose idea you like. You can also see the founder has weak points so you think to yourself that I will help the founder. I will be the mentor and help with decision making. May be you even ask for some stake in the company for advisory. It seems like a good deal and you think you will enjoy doing this mentor role as well. Well months pass by and you realise that a weekly meeting or even spending weekends doesn't seem to move the needle. The founder decision making is still stuck at 'average'. You realise that the number of decisions to be made in a start-up are far too many and far too frequent for a mentor to keep helping with. In a few months you lose your investment.'Submitting Your Intelligence' Mistake: At the opposite end is the mistake of submitting to someone's else intelligence. Say you know of a famous angel investor. And he is doing a deal and you have a chance to invest. Or say a famous actor from Bollywood is doing a deal. It is possible that you will think that if that famous person is investing it sure will be a good deal and put money in. You don't think about the idea yourself and if it makes sense or not. You submit to the other person's intelligence and world view completely.'Best I could Find Mistake' : Let's say 10 different founders approached you to take angel investment. You are now wise enough to know not to invest in 'average' founders. So you invested in the one you thought was the most capable. And you feel quite happy with yourself. But the truth is that the best angel deals actually didn't come to you. Those founders actually never approached you and you never saw the deal. And the reality can be that those founders who didn't show up at your door are 10X better than the founder you invested in. This scenario is faced by every angel investor and the only solution is to know what it takes to build a company in absolute terms. And then to identify if the founder is of that calibre and quality. You can't invest in the 'best' founder who approached you and get results. There is a certain bar that needs to be cleared for a founder to succeed in building a company. That bar also varies by sector. A highly competitive and cash guzzling sector like Electric Vehicles needs the highest bar. You have to know that bar.So how can you increase your odds?

Experienced angel investors try and avoid the 4 common mistakes of angel investing. The more experienced the angel investor the more they are open to acknowledge the role of luck. You have to get lucky to be invested at an early stage in a unicorn. So how can one increase their odds of getting great returns from angel investments? Here are 4 good ways to do it.Answer 'Why Me': The first one is to answer this question: Why should someone take money from you? If you can get to a stage where because of a certain skill you bring to the table (access to VC's, domain expertise, help with getting early B2B customers, listening ear etc) start-up founders want to take a small cheque from you, you have turned the tables. This is hard to do and not everyone's cup of tea. But this is a sure shot way to get access to deals at an early stage. This is hard to do but this increases your luck tremendously.Understanding that 'Your Actions Compound': Nobody starts out perfect. But if you found a great founder, they will refer another. Deal flow, network and your brand compounds - so if you are doing it well - the quality of deals you will see will improve every year. So how you work with the founders, how available, helpful you are will determine your future deal flow. If you are being a jackass (not signing docs on time, asking for too much information too frequently, asking for advisor equity for weekend advise) that will compound too. It is a fairly small world.'Doubling Down': The third way is to double down on the start-ups that are working. Doubling down on the winners is scary. It concentrates capital. But spotting a winner is so hard that once you find it, you should maximise it. Which means that as the start-up raises subsequent rounds, you could continue to invest and maintain your equity percentage in the company. This generally will pay more dividends than trying to spot more winners. So if you have a kitty of say 50L, don't put all in first rounds, keep 30% to invest pro-rata in start-ups that work.'Portfolio Construction': YCombinator is arguably the most successful seed stage fund in the world. Over the last 16 years they have invested in 4000 odd companies. These companies have generated 400 Billion dollars in combined valuation. Here's the bit that might shock you: 75% of that valuation has been through 4 companies: AirBnB, Stripe, Doordash & Coinbase. So even the best investors in the world generate maximum returns through 0.1% of their bets. What this points to is: you don't know which bet will be your most successful one. Hence you need a portfolio of good bets. If you have X amount to invest/year, it will be wise to split it over 5-10 bets rather than in one start-up. And then double down on winners as they emerge.Returns on Angel investment in India

A big change over last 10 years has been that seed deals have become expensive. Base valuation has increased. 10 years ago, a company which was just starting out and was an seed stage would end up raising say 20L odd at a valuation of 2 crore. Today a similar company raises 1-2 crore odd at a valuation of 10-20 crore. So you get less equity for the same money.If you invest 5L in a company in the seed round at a post money valuation of 10 crore. And the company goes on to raise say 4 subsequent rounds and becomes a unicorn, what would be your return? Assuming 20% dilution in each round, your return would be = 0.05/10* 7500 * (0.8)4 = 15.36 crore. The same money invested in 2010 would have made you 76.8 crore.The returns are still high if you get a winner. But they are lower than they were earlier. On the other hand the chance of success of a start-up have improved from before because both the quality of entrepreneurs and internet penetration has improved.There were a 37 total unicorns in India from over 10 years (2009-2019). Then in 2020 we added 11. And in 2021 we have already added about 44. So the pace of generation of unicorns has increased. But so has the base valuation and the number of angel deals.So what do you need to do to be an angel?

It doesn't take much to start off. There are primarily three ways to start the journey: find a start-up on your own, invest with a friend who has been investing or invest through existing syndicates on say Angellist, LetsVenture, FirstCheque or BFFIf your interest is to have your name on the cap table of the company, so that anyone who picks the capitalization table sees your name, then you will need to invest directly in the company. This means either sourcing the deal yourself (say a batchmate is starting or you got an inbound on LinkedIn) or investing a larger amount so that the founder wants to take you directly on the cap table.If you are ok being part of a syndicate you can register on letsventure, Angellist and start following people/firms who you think have done good deals in the past. The min ticket size starts off with 2-3 lakh/start-up. These platforms generally charge a 2% extra to process the transaction and if your investment makes money you share certain % of the gain with the platform (~ 20% of the gain).A lot of first time angel investors want 'rights' in the company. The best founders will never agree to this. And the ones that agree will in all probability never build a large company. The only right you should focus on as an angel investor is to get pro rata rights. That is the rights to invest in subsequent rounds in the company to keep your stake % same. You can let go of everything else.Final words. Why angel invest at all and what to expect?

A lot of folks angel invest thinking that the founder will listen to them but find themselves mistaken. The best founders generally take advice on a need to take basis. If you are an expert in insurance they might reach out to you in case of a specific need but might not answer your email otherwise. This might look odd but building a company takes all that the founder has. So if she plays towards keeping everyone happy, you might as well write the start-up off.If you are an angel investor and pass on a deal thinking 'I don't think I will be of value to this team", it is ok to do so if that is the primary reason you invest for. If you are doing angel investing for financial returns then this is the wrong reason to pass for. If you see a strong founder that will probably never need your help - you should back them and not let ego interfere.It is important to know why you want to be an angel investor. Is it to make money? Is it to find youngsters to mentor? Is it to be able to say at a party that you are an angel investor? Because this will determine how much you want to invest and what kind of founders, sectors and companies you want to invest in. To me, angel investment is a way to work with founders. The ability to chat with folks who are 'all in' is what is most important to me.Angel investment is an illiquid asset. That is once you invest you can't take out money unless there is an exit event. This generally takes several years (rarely below 5 years). In general giving money is always easy. Getting it back is always difficult. In angel investment there is no downside protection. If the start-up doesn't work there is a high chance of you losing your principle itself. So invest an amount that is not painful to lose.And enjoy the ride that only founders can take you on.

Annual Letter to Friends - 2018

This was written in 2018 after we had sold CoCubes and moved to Mumbai after spending 13 years in Gurgaon

Hi there!

This is the first annual letter I am writing. It’s a new thing you see, one that will hopefully last. It comes not at the end of year when we are making resolutions but at the end of financial year when we start being more practical about the next year :-)This is being sent to friends, the goal being to share. In this whatsapp world, we rarely write to each other. I remember being in school and having pen pals and writing letters. Then being in college and writing long emails. But recently it’s all been reduced to writing whatsapp messages. So when we meet each other - we feel like we are updated but we are actually not. I wanted to write this to share with you what happened to me last year and share some of the links, books, videos I found interesting.Last year has been different for me. I moved cities, Diya started communicating, I took fitness seriously and worked out 6 days a week, went on a mountaineering expedition. Honestly I had more time on hand then I ever did for so many years before. And I used it.Thinking about more than work – about myselfThis was a year where I started thinking about personal goals, about living healthy, about minimizing impact on environment. And did several failed experiments but did make progress. I remember telling Bhakti that I am now going to live with only 3 pants, 5 shirts, 5 t-shirts, 5 undergarments. And segregated my cupboard into two parts all the while taking Bhakti’s view on which 5 t-shirts did she like. But the experiment lasted only couple of weeks coz I ran out of undergarments to wear as this didn’t sync with how the clothes were being washed, dried. So I dropped the idea J.First time I tried leaving chicken it worked for 4 months odd after during which I got frequent advice that given my fitness regime, I need to be taking more proteins (which I don’t think is true) plus it was difficult to eat outside and resulted in more expense or Bhakti, friends eating vegetarian. So I made a compromise, I eat meat when I am having meal with someone and I avoid it when eating alone. Here is a good article on why we should genuinely no longer eat chicken - http://www.thehindu.com/news/national/a-game-of-chicken-how-indias-poultry-farms-are-spawning-global-superbugs/article22597845.ece. If there is one meat you could do well to avoid, it is chicken. If you are really interested in knowing about how the meat you eat is made – read this 4.2/5 rated book by a father Jonathan - Eating animals I just finished it on recommendation from a friend and I think it is brilliant.I reduced my sugar intake by a lot. I still like to eat ‘toast’ (or ‘rusk’ as some of you might know it) and an occasional chocolate or ‘chikki’ or ‘chips’ but apart from that sugar consumption is 80% down from earlier. If there is one thing you can change in your lifestyle, it is to remove sugar from your house. Time and again research has shown that ‘fat’ is not the problem in our life, the problem is sugar. Another research now has proved how cholesterol has no correlation to heart attack. Here is a 2002 article from New York Times that makes the case against sugar and how we are deceived to eat it in so many ways and forms and the blame put on FAT - https://www.nytimes.com/2002/07/07/magazine/what-if-it-s-all-been-a-big-fat-lie.html.Moving to MumbaiIt was not on the cards. I think it seriously came out in discussions when our close friends moved there. I remember the conversation when I said to Bhakti, you find a job and we will move. Little did I know it will happen in 15 days from that. This has been our biggest experiment - moving to Mumbai. Life in Gurgaon was easy, comfortable with everything sorted including maids. While we moved coz Bhakti got a job in Nomura, but my internal reason was also the increasing pollution in NCR. One becomes more conscious of these after having a kid and I saw no reason why Diya should breath toxic air. Plus with all my running leading to deep breathing, the impact on my lungs would also have been substantial. And so we moved. It’s not been easy, but it has been a change. And I think change was necessary to get out of my comfort zone. 6 months here and we are still figuring out stuff, maids not set and we miss Gurgaon friends. But life moves on :-)MountaineeringI remember Vishnoi (friend from IIT Kanpur) being the one to introduce me to mountaineering. We in 2006 went on an expedition which was baptism by fire for me and I was hooked. And we went to so many more expeditions after that together – it is one of the most fun times I remember. And I remember making a promise to myself that I will go do it with my friends each year for 2 weeks. It doesn’t seem much but 2 out of 52 weeks is 4% of the year. It is a serious amount of time to commit!Last year I learnt mountaineering to me was not only about the mountain but about climbing with friends. I went on a 45 day, $30,000 expedition and came back in the middle. It felt good then to come back but I have questioned it time and again in my mind and I do think that I should have spent the 2 weeks more and climbed. I had been preparing for an year, putting about 500 hours of training into it and money. More importantly it seems like unfinished business. But it is always easy to say this when you are sitting in the warm 30 degrees in Mumbai and difficult to follow in -10 degrees of snow for days. But there are two things I hope to do next time when there is an important decision to make1. To talk to someone who knows me to take their input coz your mind starts playing tricks on you when you have to make hard choices.2. To think about each decision in the manner of ‘how will I feel about it 10 hours from now, 10 months from now and 10 years from now’. I think that really puts things in perspective and snaps you out of the immediate mind frame and constraints one is inIf you really want to how it feels like to be alone in the snow or on a lonely journey – read this article - https://www.newyorker.com/magazine/2018/02/12/the-white-darkness - it is one of the best articles I have ever read on adventure. If you really want to see how mountaineering looks like and how unfinished business can look like see the Movie Meru – https://www.youtube.com/watch?v=YvS6O9lVkkg – this is the trailer – the movie is on Netflix.The question I struggle with is – How do I tell Diya when I see her before the expedition that I will be back after 2 months? How do I explain to her how long are 2 months? How do I explain to my daughter why I want to do it ?Schooling and EducationThat brings me to kids and education. With Diya growing up and school just around the corner I spent considerable time reading about schooling. It is interesting how ones thinking evolves as one spends time on a topic.1. Think point 1 - It started with researching about which schools are good2. Think point 2 - Moved to thinking about which system of schooling was good – like the Waldorf or something else3. Think point 3 – are schools good?This finally resulted in attending a conference on un-schooling and homeschooling. I met parents who have home schooled their children, I met children who have been home schooled and they looked fine confident young people. Homeschooling seems like a hard thing to do. And there are so many thoughts between which I get torn – like having seen how bad the education system is it seems almost criminal to send kids to school sitting in neatly lined benches essentially understanding to be ‘complaint’. At the same time I think about how all of us turned out fine after going to schools. I think the difference is that when we were going ourselves we didn’t have a choice but for our kids we do have a choice. I think schools and colleges are not made to study but to keep youth from straying on the wrong path, to pass time till we get to an age we can be productive and be admitted to jobs. Somedays it feels to me that it is criminal to drop your child off at 11:00 am in the morning and forget all about her till 6:00 pm when you pick her up. It is so convenient but is it right? It is a question I struggle with. A larger question that ties up with this is - what is the responsibility of the parent when your child is young? Is it to raise a successful child, is it to give her the best of everything, is it to make her able to live in the world? Or is it to make her happy or to raise her into a happy adult? To me the last one sounds right. So if it is only about raising one into a happy adult then why think so much about schooling. She can be happy irrespective of whether she achieves her full potential or not so why does it matter. These are questions I I have thought about after becoming a parent but don’t have answers to. What I know for sure is that giving her a happy childhood is important, one where she understands she is not special but she is unique. She is the only person in the world that can be her.As I researched about schools I came across Summerhill - http://www.summerhillschool.co.uk/- it’s tagline is ‘Founded in 1921 and still ahead of its time’. It was the original free school where one could do one wants and has produced happy adults (as far as I have read). The book by its founder AS Neil is a must read to understand children and to hence understand oneself before we became corrupted by the world - https://www.amazon.in/Summerhill-English-S-Neil/dp/8189976028 (I wanted to give a Flipkart link but sadly they don’t have it for INR 215. This is a trend – the original online book selling company doesn’t have all titles anymore)RunningA side impact of mountaineering goal has been running. Because I came back from mountaineering, I still wanted to do something and signed up for the 72km Ultra Marathon in Leh which thankfully I completed and found some solace. I used to hate running till a few years ago. It seemed quite pointless to do and honestly it can be painfully boring. I do think that it does have correlation with IQ, higher your IQ, the lesser your chances of running longer. But I have started running longer, so my IQ is dropping by tons. But hopefully I am becoming wiser. I can tell you from experience that running will make you a happier person. And if you are taking your bath everyday then you can find time to do 30min of running too (alone or join a running group). And it will make your day happier and hence more productive.

Given that we are now in Powai, one of the most loved perks is that I can go to IIT Bombay and run by the lakeside. It’s a great start to the day!

Below are couple of running books that I liked in the year· If you want to read a good book on how running can change your life read this by Murakami (one of the world’s finest writers) - amazon link . Adi Wealthy.in sent it to me earlier this year!

· If you want to learn more about the anatomy of running and injuries, how to treat them, get this - amazon linkGoing forwardCouple of years ago I took two decisions – that in the future I should never be in the position that I say· I didn’t spend enough time with my parents and· I shouldn’t say I didn’t spend enough time with my kids when they were youngOne can get money, one can get fame but one can’t bring back time. So life seems too short and too long at the same time right now. The more time I spend with family, the less time it seems I have. But this also won’t last, I am already itching to do something more than what I am doing right now.

Cheers to the year ahead and thanks for being there!Happy Singh

The case for an Indian "Lambda School"History of Coding Jobs and Training in IndiaSometime back I read in an article, "That in India, jobs is not a problem. Wages paid for the job are the problem." This is as true for the white collar as it is for the blue collar. Wages are a result of the value that an employer can derive from the employee and hence highly correlated to skill. So the real problem in India hasn't been lack of quality jobs. It has been lack of quality training.India has produced mediocre engineers for far too long. In short: it has been a systemic fault. In this piece I want to look at why that happened and how it can change. And what I believe the new age online colleges need to do to succeed.But before that a brief of where I am coming from. Along with Vibhore, I co-founded CoCubes. The name CoCubes comes from the first two letters of three words, connecting, colleges and companies. We started as a connection platform, moving to becoming an online assessment company, finally being bought by Aon Hewitt, the second largest assessment firm in the world. We were among the first players in the country to have an automated coding evaluation engine and an automated written English skills test. In the last 12 years, the CoCubes team has met thousands of corporate across sectors and I believe every engineering college in the country. If there was a student in the final year of an engineering college, we have met that college. If there is a corporate hiring an engineer or a graduate we have met them.Well back to the story.1990-2001

Coming back to producing mediocre engineers. In the 1990's when the first boom of hiring people with computer skills started, NIIT centers were the place for corporate to go and hire. NIIT conceived a franchising model in IT education for the very first time, setting up nine centers by 1987. In 1992, NIIT launched its flagship program GNIIT, an industry-endorsed course with a 12-month Professional Practice for students seeking careers in the IT and non-IT sectors. By 2001 the company had earned the enviable epithet, the ‘McDonald’s of the software business’. And it was the go to place for folks looking to people with knowledge of computers.2001-2009

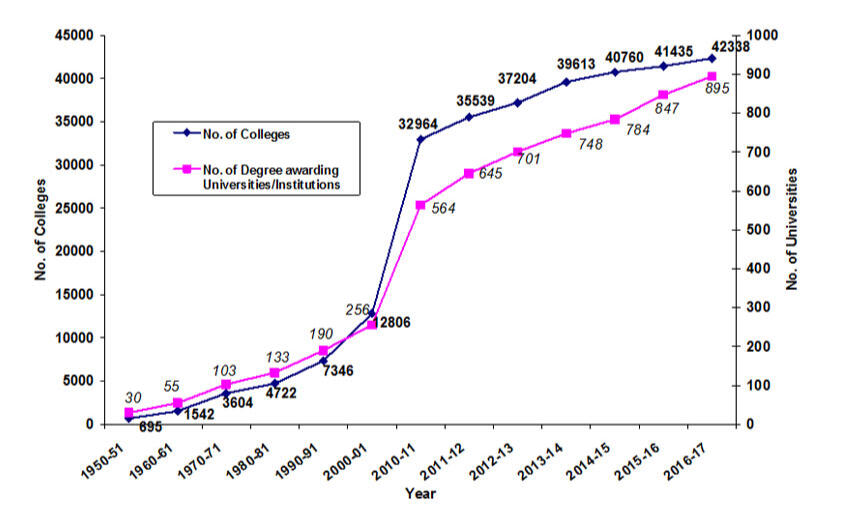

In 2001 Infosys hired 4,442 new employees. Double of what it had hired in 2000. The Indian software industry had just begun hiring in droves and that was about to accelerate. And this is when NIIT gave way to private colleges. Local business owners sensed this opportunity and between 2000-01 to 2010-11 there was a 1074% increase in colleges in India primarily to cater to the demand of the services industry - namely TCS, Infosys, Cognizant, Patni Computers, Accenture and the likes.

For the Indian IT services industry revenue was based on number of hours of work done which was proportional to number of people deployed so there was incentive to keep adding headcount. Which is what happened. The mass hirers would go to a college and pick hundreds of students in one go, with the entire IT industry hiring about - 200,000 students in an year. Then the candidates would spend about 6 months in training learning java, .net. and clearing in house certifications before being put on projects on shadow and becoming productive in about 8-12 months.Here's a hilarious video on campus placements by AIB: https://www.youtube.com/watch?v=6X-SG6bA4ZgThe criteria to hire was simple - clear an aptitude test of 60 min. Get a job worth INR 250,000.By 2009 IT Services companies were hiring in bulk with TCS alone adding 48,595 new employees in a single year. So students started joining engineering colleges in droves with just one dream: to get a job in IT service industry. Engineering college had no incentive to get kids to pick any skill. What only mattered was that 60 min aptitude test. So in the final year of engineering training for the test would start to ensure that kids got through. A bright kid would come out of 12th class and do time pass for 4 years in college because everyone knew that the only thing that mattered was clearing an aptitude test and not skills.2009-2015

Post 2009 a few things changed the equation.

- Growth in IT industry slowed down. IT companies started feeling the pressure of margins. One of the ways to improve margins was to reduce hiring and training cost which meant hiring folks who are better trained plus ensuring entry level compensation remained the same

- By 2015 IT companies had also started feeling the burden of the 'mid layer' - engineers who had joined from colleges and continued to stay on same projects year after year were now at a compensation which was unsustainable. This was because the skill growth hadn't happened along with growth in salary.

- Finally investments in start-ups had taken off in India and more products were being built in India by the MNC's (like Microsoft, Adobe). This led to a clutch of IT Product jobs in the market where compensation was >INR 800,000/annum. This was the first time there was real incentive for colleges to teach coding to kids in college. Which started to happen in top colleges in the country.IT Services continued to hire engineers at INR 300,000/year with an aptitude test of 60 min. The salary did not keep up with inflation coz demand exceeded supply of candidates.IT Services also started hiring vanilla graduates (without maths background) at INR 250,000/year oddIT Product jobs came to the market at >INR 800,000/year resulting in colleges investing in teaching programming to kids.The 'vanilla graduate' hiring proved that engineering colleges weren't really adding value, the jobs with corporate were not really coding jobs and most importantly if they get a 'body' at the right price, they are ok to overlook the engineering degree. Students were now spending between 5-12L for the engineering degree while the overall placements in campus were hovering around 25%. In the top campuses where students would be spending ~8L for the degree, the bulk were hired still by IT Services organisations. Meanwhile engineering institutes in the country continued to grow with student enrollment hovering at around 50% each year (this means that though the number of seats in engineering colleges were X only X/2 were being filled year after year)IT Services companies introduced a technical test for hiring of entry level engineersTowards 2015 companies criteria for hiring people who had graduated but not gotten campus jobs got stricter. Now the candidates had to clear a technical test too to get in the company. Because campus placements were around 25% these were also the years when training after college for Java and .net started happening. One of the leading players Talentsprint raised VC capital and started teaching kids who had graduated but had no jobs. Essentially offline bootcamps. This is the model that led the offline training market the next few years. In general one could learn coding offline by spending anywhere between INR 2000 with a local teacher to INR 25000 with a branded centre. Also a lot of firms started emerging to test coding skills online (like Hackerrank).2016-2019

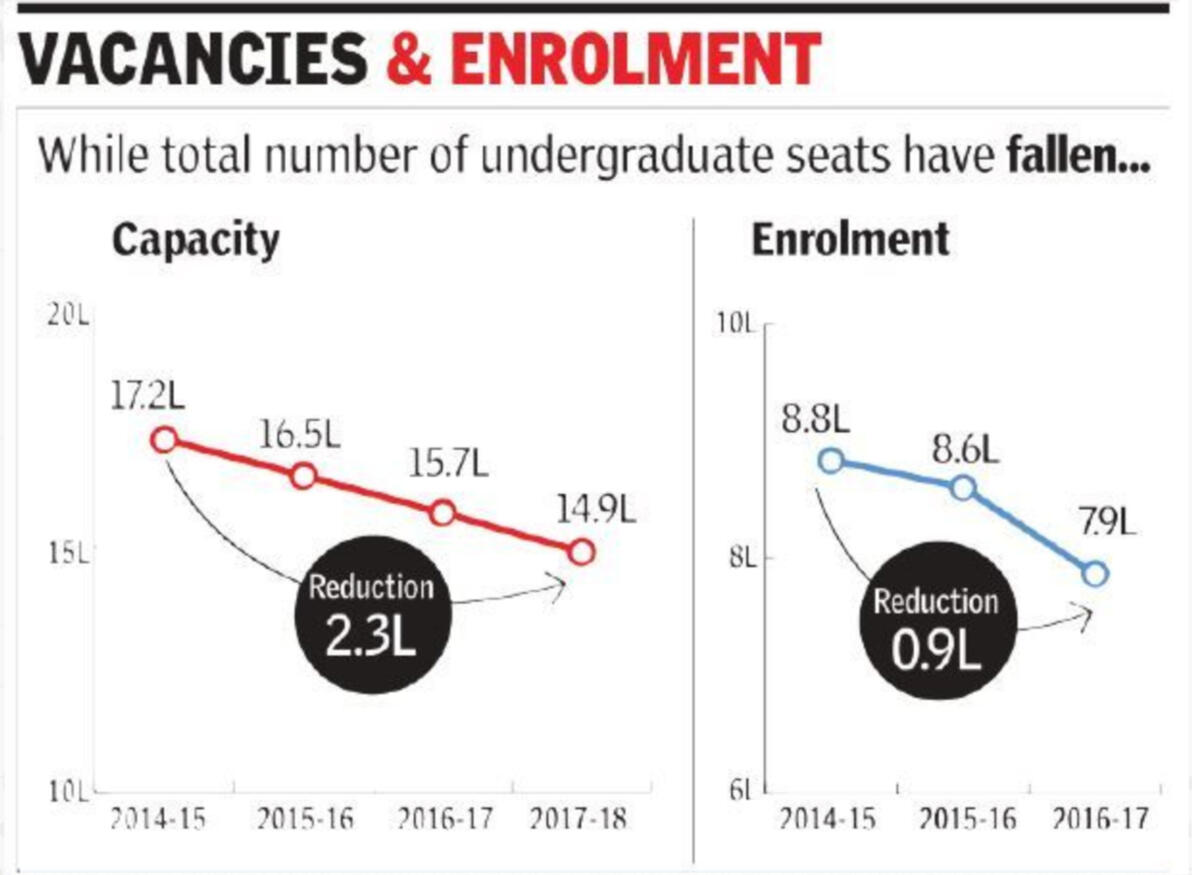

With the average campus salaries not rising and on-shore opportunities decreasing realization had begun to sink in parents and students that engineering is no longer a golden ticket to an upper middle class life. But the Indian market has depth in terms of 'parents' and aspirations. So while colleges started closing down the enrollment ratio still stayed at 50%. This also coincided with

- IT companies revenue model was starting to change. Clients now wanted to pay for outcomes rather than effort. So the focus shifted to hiring higher quality candidates over #of candidates

- This resulted in a new band of hiring starting to happen in IT Services: people with coding skills at ~INR 800,000l/Annum

- IT companies reduced tie-ups with colleges and started being college agnostic to promote equal opportunity (as now there was no need to ensure that a single college should give 1000+ candidates in one go)

- Start-ups with funding had taken off and were willing to pay high compensation for skilled candidates from college

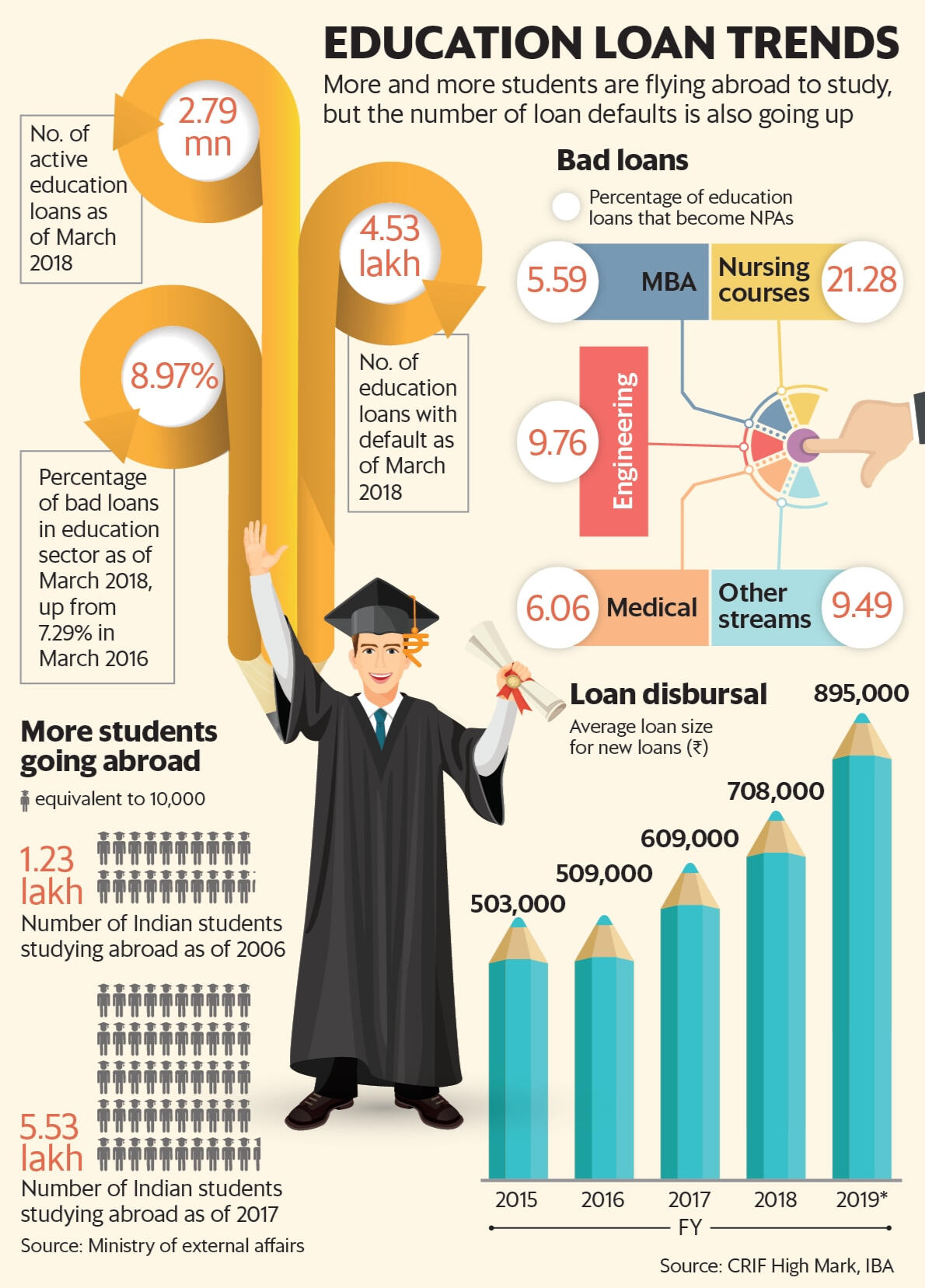

Over the entire course of 30 years from 1990 to today, the things that has held true is that corporate have set the course for what is acceptable quality. Colleges follow suit. When IT Services hired only on the basis of 60 min aptitude test, colleges only taught that. Once they introduced the technical test, colleges started teaching that. As the number of start-ups hiring for product jobs increased, the better colleges started investing in teaching coding skills as well.And because 'colleges rarely help gain skills' the ROI on an engineering degree has steadily dropped. In 2005 one could pay 4L/annum and get a job worth 2.5L/annum. By 2018 for the good colleges fees had risen to 8L/annum while the IT Services jobs were still priced at 3.5L/annum. Loan for education has risen and so have NPA's.

Why have training companies failed so far - both offline and online?The shift from NIIT to colleges happened because parents and students 'wanted a degree'. Why take a certificate when you can take a degree and get a job as well. And once parents have paid the 8L for getting a degree they will not spend a similar amount for a coding school later. Hence the average spend has been <25,000 rs for learning Java. And this killed almost ALL training companies. None could succeed. Coz you cannot correct 16 years of academic inefficiency through a 3 month coding bootcamp.For any training firm to succeed - what was and is required is

- Find candidates with hunger to win and enough cognitive ability to be able to write logical code

- Ensure they are trained well - both technically and for HR interviews

- Ensure they get enough interview opportunitiesGiven that CoCubes has connect to almost every corporate and college we ended up being reached out by almost every large and medium training firm in India. And this is what I heard from a lot of founders running training companies in India.

- People with hunger have already done well and gotten a job. Folks left don't have passion and don't want to work hard

- Training is a high touch job. It always broke at scale.

- The teachers were not the best paid folks hence the quality of teaching suffered

- Revenue/student was always a challenge. Nobody wants to pay for training, everyone wants to pay for a job.

- Getting job is not easy. Even with 'unlimited interviews' being offered. This was a culmination of not the right pick of student and average teaching.So what will it take for an 'Online Coding School' to become really BIG?

So there are two key problems to solve for

- Quality of input coming into the 'online coding school'

- Increasing revenue/studentThe income share agreement (ISA) model solves for the second piece. Do not charge much upfront and charge a % of the income the person earns after getting a job. This let's the 'online coding school' make $5,000/candidate as opposed to $500 that have been made from 1990-2020. But this puts the onus on 'performance' i.e. the student has to get a job.If you are making $5,000/candidate, then one can employ better teachers and one can increase their job network. But the key part still remains: quality of candidates.Going online makes execution of training and assessments easier but it does not improve the quality of candidates who come for such training. Because the 'best candidates' which means the candidates with the logical and mathematical ability to become good programmers are already in college and have an 'IT Services' or other job and they won't sit for such a program again.So what it will take for an 'Online Coding School' to become really big is for

- Either candidates to choose an online coding school over college. The fascination for having a degree to go. Which can happen but will take years.

- 'Online Coding School' to become a coding college. Which is where the most famous online school - Lambda School has gone

- Employers to accept 12th graduate kids with coding skills and give them the same jobs they give to college graduates. Which can happen but will take years.Take your pick. I think all three are hard and if making money is what excites you a much simpler market is to teach coding to kids.

Life is shortNothing you do matters

But do you must

So do what you find joy inJoy comes from sustained effort

Effort put out of interest

Interest that is free of praise, punishment and rewardStop effort once in a while

Reflect and do 2 simple checks

Checks of longevity and mortalityLongevity: Think ahead 10 years and look back

How does your older self feel about the choice made 10 years ago?Mortality: Think you are going to die day after

Would you still spend your last day doing what you chose?Re-adjust your choice of effort if required

Don't carry the burden of choice for life

Take it a step at a timeTime spent like this will fly

So do what you find joy in

It matters what you do

Life is short

Harpreet Grover and Vibhore Goyal met in college and then spent the next decade of their lives building a company before exiting successfully.One way to tell their story is this: they had a dream, they followed it and, then, through perseverance, they made it come true.But that’s not really the truth. Like everything in life - at least everything worth having - it wasn’t that simple. There was blood, sweat and tears, there was loss of capital, loss of friendship and even a loss of faith along the way.It started with a phone call from Harpreet’s mother introducing him to an uncle who wanted some help. Or maybe it started when Vibhore and Harpreet met as roommates in Room 143 at IIT Bombay. What remains true is that soon both had quit their jobs and launched CoCubes. From no money in their bank accounts for eight years after graduating to becoming dollar millionaires two years later in 2016, this is a tale of grit - of a company built in India by two Indian-middle-class 20-somethings-turned-entrepreneurs - written in the hope that you can avoid the mistakes they made and learn from what they did right.This is that story - the story that you don’t always hear. But if you want to be an entrepreneur, and you prefer straight talk to sugar-coating, it’s one you should listen to.

There exists only one kind of child in this world.

"A child absorbed in doing something without need of praise, reward or fear."

CoCubes was a 12 year long experiment where I learnt that graduates are hard to change. Their personalities are developed. So unless a big life event happens to them, changing them from outside is difficult. In the 20-40 age group, we are like an arrow shot from a bow. Most of us have been told that if we get good marks, get into a good college, get a good job, and have kids we will be happy. It is only when we do all this and realize why I do feel something is missing, is when we start thinking for ourselves.After selling CoCubes, I spoke to lot of successful and rich people who are 15 years ahead of us. And asked them ‘if they had any regrets’ about the last 15 years. And all of them said the same thing, “we don’t remember when our children grew up”. They wished they had spent more time with them.Both the above reasons together led me to spend time with my daughter, my neighbors kids, my friends' kids, and random kids. Observing them, having fun sitting and laughing with them. This led me to take courses, do experiments, read books, consult psychologists and put all the skills I had gained in the last 20 years into discovering more about children.I declined offers from venture capitalists to launch a new company or to become a full time investor. Instead I joined boards of non profit companies like Labhya who do wonderful work on creating social emotional programs for 4.5 million kids across India including the Happiness Curriculum implemented in all Delhi Govt. Schools. I invested in EdTech companies like Kutuki, Yellow Class and others to continue to learn about children.I see my friends running around, making time for kids between calls and presentations. I think parents today are busy, but all of them want the best for their child. Most parents won’t have as much time to spend as I have had.At the start kids are shaped by their genetics and environment. And the environment (how kids spend their time, time in nature, who do they play with, which school etc) is determined by the parents.In 2022 I am starting to share what I have observed and learnt as an independent researcher on children and parenting. Hence The Curious Parent

Also below are a few books you might enjoy reading :